In global logistics, insurance is often seen as a safeguard. But the reality is simple: insurance only acts once the damage is done. A claim might cover financial losses, but it can’t recover lost time, restore shelf-life, or protect patient outcomes.

Why Insurance Isn’t Enough

Shipment insurance has built-in limitations:

- It’s reactive—coverage only applies after an incident.

- Claims often take weeks or months to resolve.

- Payouts don’t restore delivery windows or regulatory compliance.

For time-critical or sensitive cargo—organs, biologics, pharmaceuticals, or temperature-controlled food—waiting for reimbursement isn’t an option.

The Risk of Sensitive Shipments

- Healthcare: A failed delivery could mean a missed transplant or a delayed trial.

- Food & Cold Chain: Even a small temperature deviation can spoil a load. Insurance may pay for goods, but it won’t prevent shelf-life loss or customer frustration.

GEGO Tracking Solutions: From Reaction to Prevention

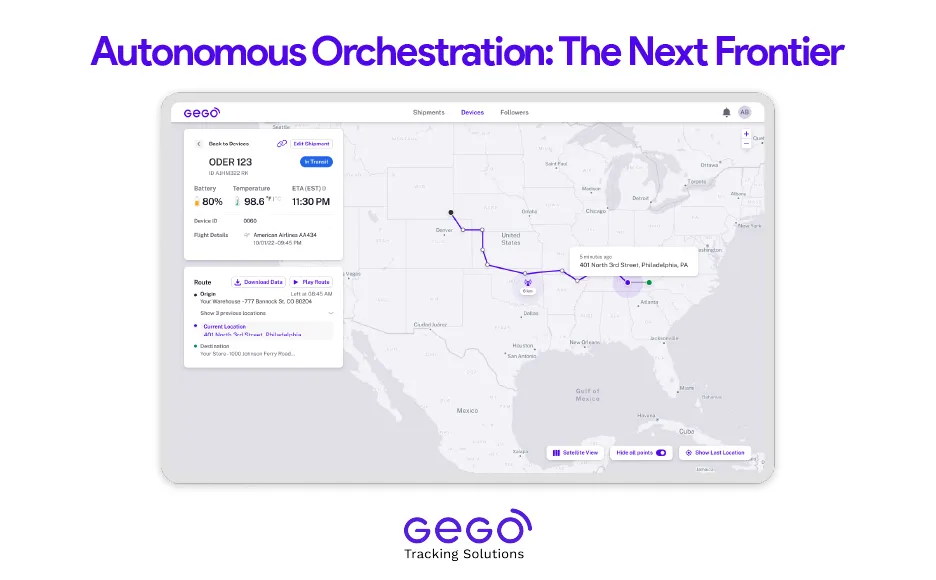

This is where proactive monitoring makes all the difference. GEGO’s software platform transforms visibility into control by providing:

- Real-time GPS tracking of shipments worldwide

- Environmental monitoring (temperature, humidity, shock, motion)

- Instant alerts for tampering, route deviations, or delays

- Geofencing to secure delivery routes and hubs

- Compliance-ready audit logs and chain-of-custody data

Instead of reacting after damage, operators can intervene in real time—reroute, replace, or escalate before cargo is compromised.

Side by Side: Insurance vs. GEGO Tracking Solutions

| Feature | Shipment Insurance | GEGO Tracking Platform |

|---|---|---|

| Financial reimbursement | ✓ Yes | N/A |

| Real-time tracking | No | ✓ Yes |

| Sensor data (Temp, Humidity) | No | ✓ Yes |

| Alerts & exception handling | No | ✓ Yes |

| Compliance support | Indirect | Direct |

| Response time | Post-incident | In-transit |

The ROI of Real-Time Visibility

While insurance covers costs, GEGO helps avoid them altogether.

- Fewer rejected shipments due to spoilage or mishandling

- Reduced claims and premiums over time

- Stronger compliance with audit-ready records

- Increased customer trust and service reliability

Final Takeaway

In logistics, insurance is necessary—but insufficient. Insurance reacts, GEGO prevents.

Discover how GEGO Tracking Solutions Software Platform can protect what insurance can’t. Request a demo today.